Funding Sequence & Structures

At Next Level Wealth, we help you secure the business funding you need — the right way, in the right order, with the right structure. Our proven funding system is designed to help you qualify, apply, and get approved with major banks and lenders while protecting your credit and increasing your limits.

Bank Sequences

Getting approved for multiple business credit cards requires strategy. Our funding sequence shows you exactly how to apply across top banks in the right order — helping you build high-limit credit without triggering denials.

Here’s how we guide you:

Start with American Express to establish a strong foundation.

Move to Chase, Bank of America, Wells Fargo, PNC, and Citi Bank following our daily application plan.

We show you when to open accounts and how long to wait before your next application.

Then, expand with Sam’s Club, Navy Federal, Costco, and Capital One to diversify your portfolio.

*Every step is planned to maximize approval odds and protect your credit profile.

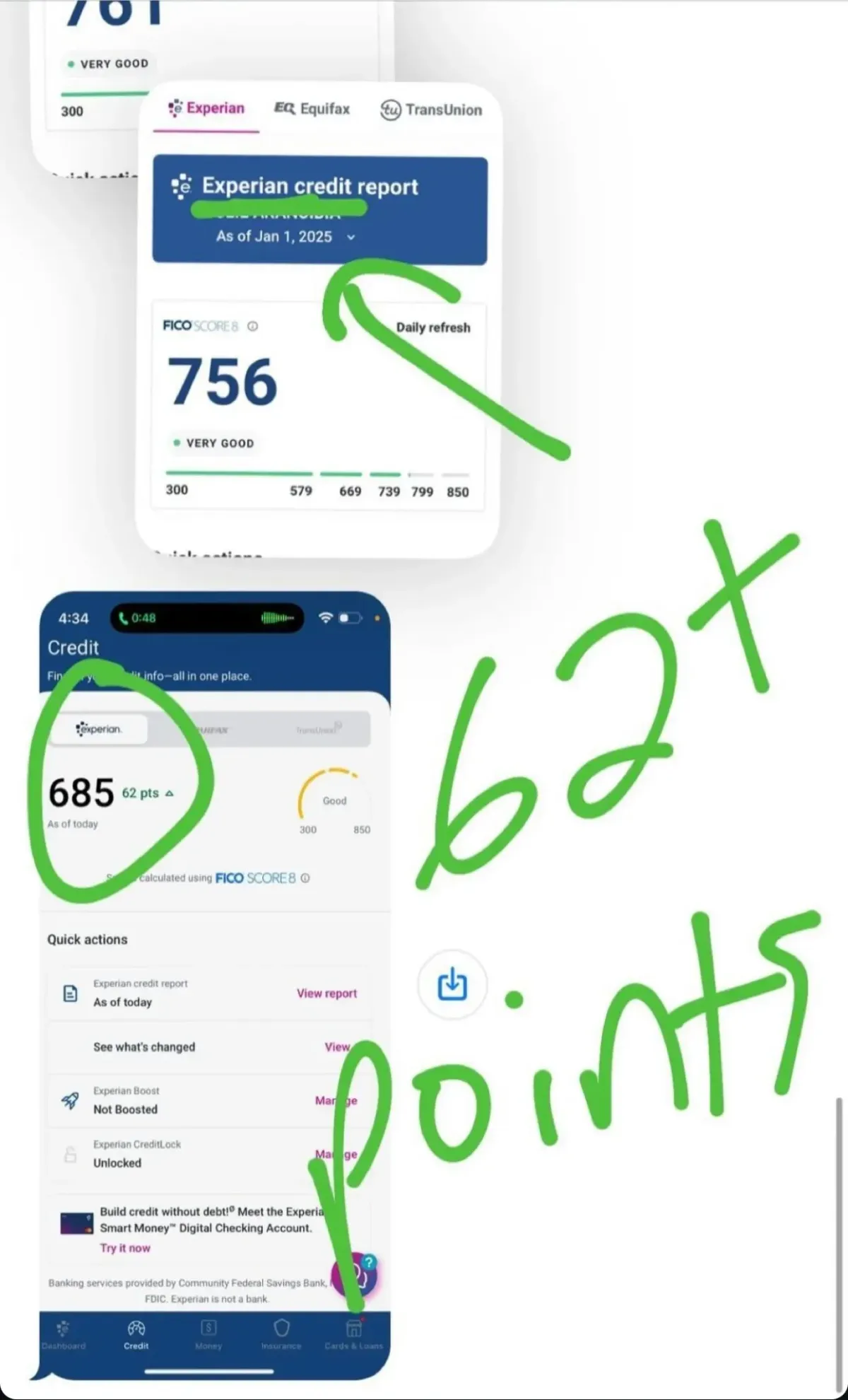

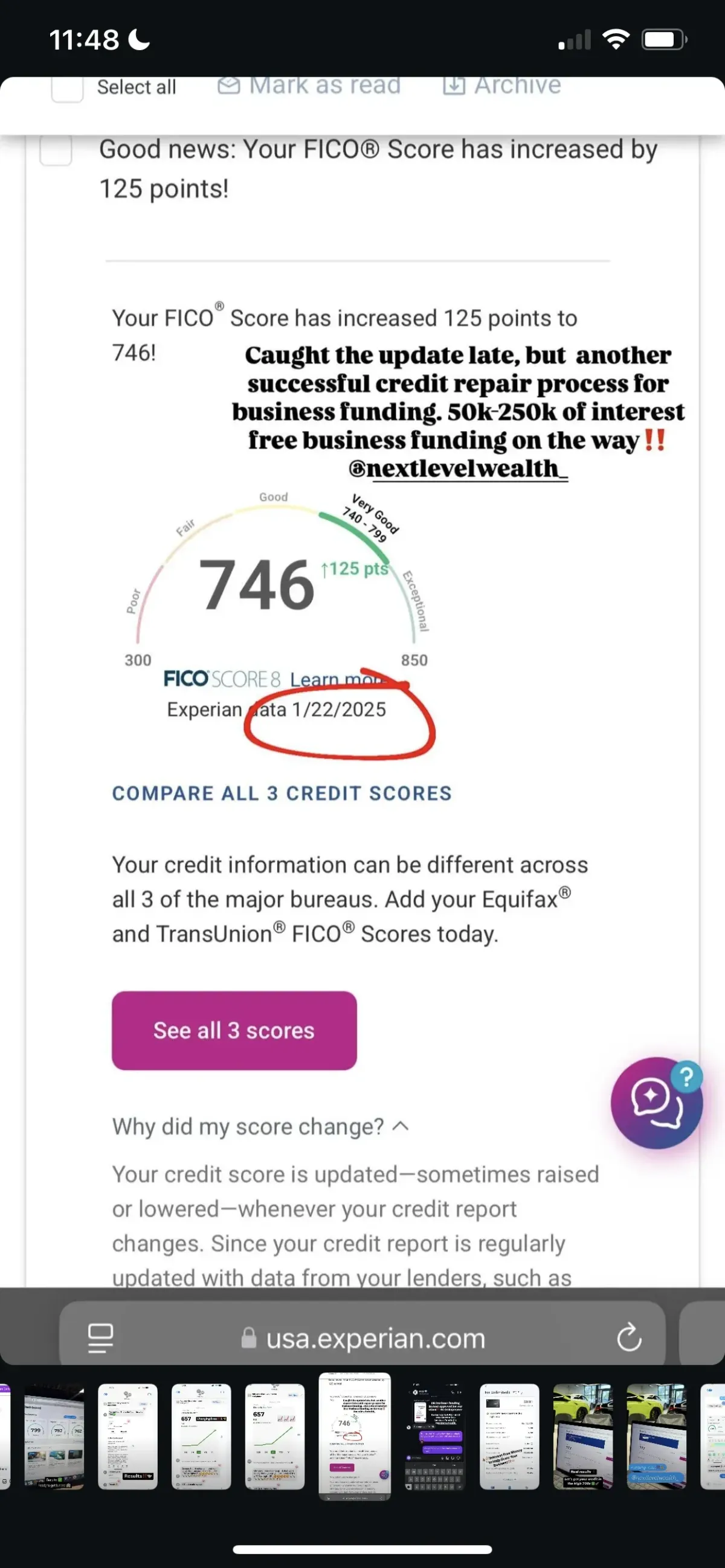

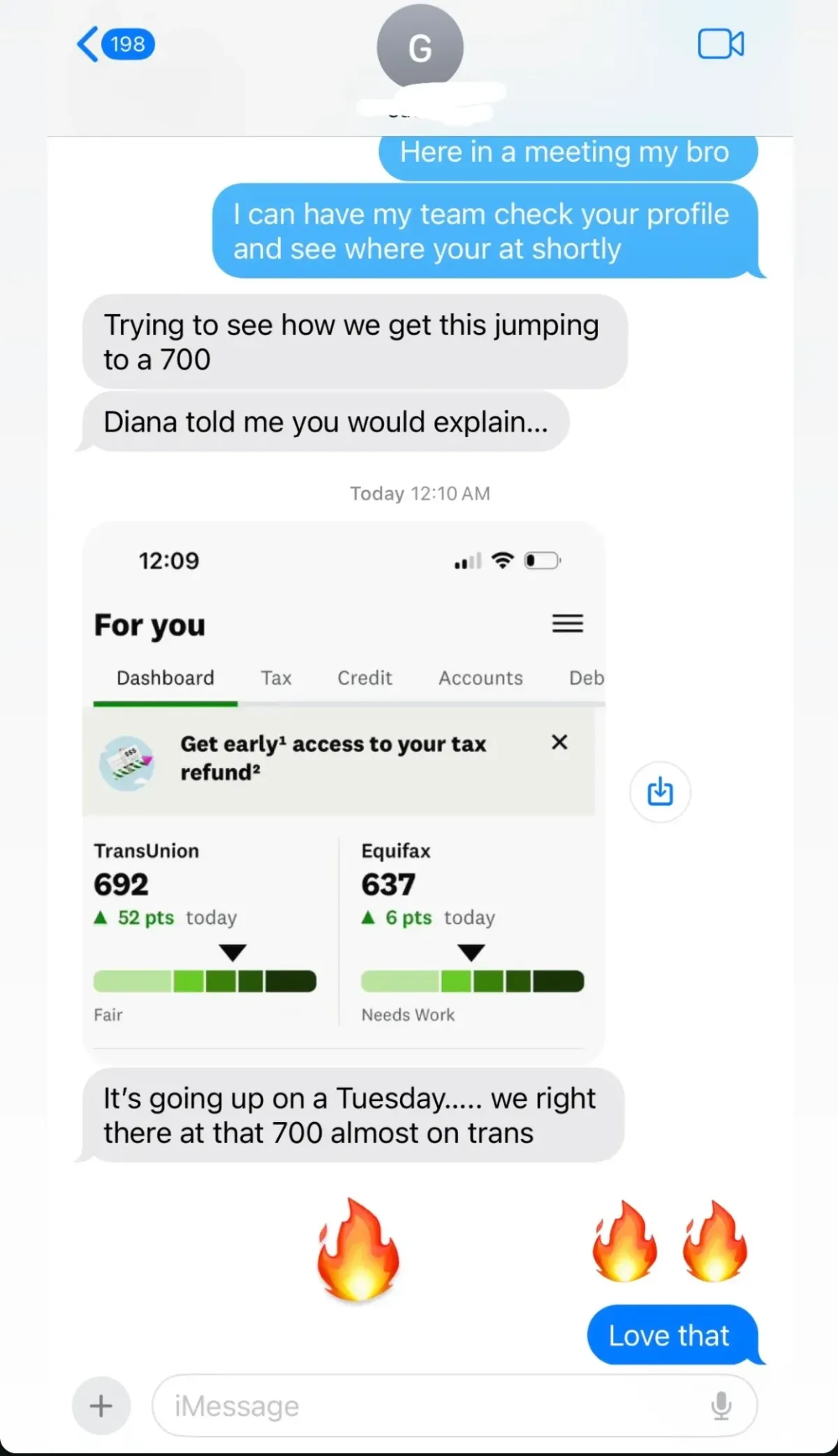

Need credit revision?

Funding Structure

We help you understand and use different funding products to match your business goals.

Our team builds a clear plan using credit cards, lines of credit, and loans to manage growth and cash flow effectively.

Funding options include:

Business Credit Cards – Ideal for daily business expenses and rewards.

Business Lines of Credit – Flexible funds for short-term cash flow.

Business Loans – Lump-sum funding for expansion or equipment.

Personal Loans – Fixed-rate borrowing that can improve your credit profile.

Basic requirements to qualify:

Credit score of 700+

Business age of 2 years or more

No more than 3 inquiries in 6 months

Credit usage under 10% per account

We help you meet these requirements and position your business for approval.

Maximizing Business Funding

Once you qualify, we help you scale your total available funding across multiple institutions.

Our tiered funding system connects you with both major banks and secondary lenders to reach higher limits faster.

Tier 1 – Major Banks

American Express: Up to $150,000 – apply online

Chase: Up to $150,000 – apply in person

Wells Fargo: Up to $250,000 – apply in person

PNC, Truist, Citi Bank, U.S. Bank, TD Bank: Up to $100,000 each

Tier 2 – Retail and Secondary Lenders

Sam’s Club, Navy Federal, Costco, Discover, Capital One: Up to $50,000 each

We also help you create multiple LLCs or corporations through our accountant network, allowing you to multiply total available funding across different entities. All applications are structured to fit your credit profile, revenue, and business history.

Customer Guide

Before applying for funding, we make sure you’re ready to qualify. This includes reviewing your credit, inquiries, and account usage to ensure you meet each bank’s standards.

We help you prepare by checking:

Credit score of 700 or higher

No more than 3 inquiries in the last six months

Less than 10% credit utilization

At least one personal revolving account with a $3,000 limit

Consistent business details across all applications

We take care of the setup so your applications go smoothly.

Sales Team Guide

If you work with our sales team or refer clients to us, this guide shows how we structure funding programs for every type of business. It outlines how we assess client profiles, recommend the right funding products, and submit applications correctly.

Inside the guide:

Overview of all funding products

How we evaluate credit and business history

Matching each client with the best lender

Application tips that increase approval rates

How We Help You Grow

At Next Level Wealth, our mission is simple — to help you qualify for the highest levels of business funding while building lasting financial strength.

We don’t just help you apply for credit; we structure your business to succeed.

640-650 NE 128th St, North Miami, FL 33161